For businesses investing in renewable energy, installing solar is just the beginning. Many of our clients are now pairing it with a Battery Energy Storage System (BESS), which unlocks the full potential of the solar installation. But how do you maximize the return on that investment? The answer lies in understanding the two core ways a BESS creates value—and knowing which one to prioritize.

The Foundation: Overnight Arbitrage

The basic value proposition for BESS is grid arbitrage: buy low, use high. The BESS can charge overnight using cheap, off-peak electricity imports and then discharge in the morning to reduce expensive peak-rate imports.

This strategy is the bankable base case for most solar + BESS projects. It’s predictable and easy to model because it’s based on your site’s own electricity tariff. More speculative revenues from wholesale grid services (such as frequency response) are subject to rapid market changes and require specialized BESS configurations, so can’t be guaranteed.

However, overnight arbitrage does rely on a crucial assumption: that a sufficient price difference between peak and off-peak electricity will remain long-term. As more storage is deployed across the grid, this price spread is likely to narrow, potentially eroding this foundational revenue stream over the life of the asset.

The Prize: Exploiting Your Solar

While grid arbitrage is a solid foundation, the real economic driver of a BESS is charging it with your own low-cost solar energy. The challenge is that solar generation rarely matches a site’s demand profile, and so the BESS stores solar energy for later use.

Our detailed modelling of a typical solar + 5MW/10MWh commercial system shows the sharp difference in value streams. Overnight arbitrage creates a net profit of 4.5 p/kWh, whereas storing using solar energy is worth 11.5 p/kWh. That’s more than double the value for every single kilowatt-hour cycled by the BESS.

The problem is that a static or fixed solar array doesn’t generate enough consistent power to fully charge a BESS throughout the year, increasing your unit cost of storage. The key to improving your returns is optimizing the solar + storage combination. But how?

Unlocking Value with Solar Tracking

A simple solution to maximise the value of your solar is more consistent generation. This is where solar trackers are a value multiplier.

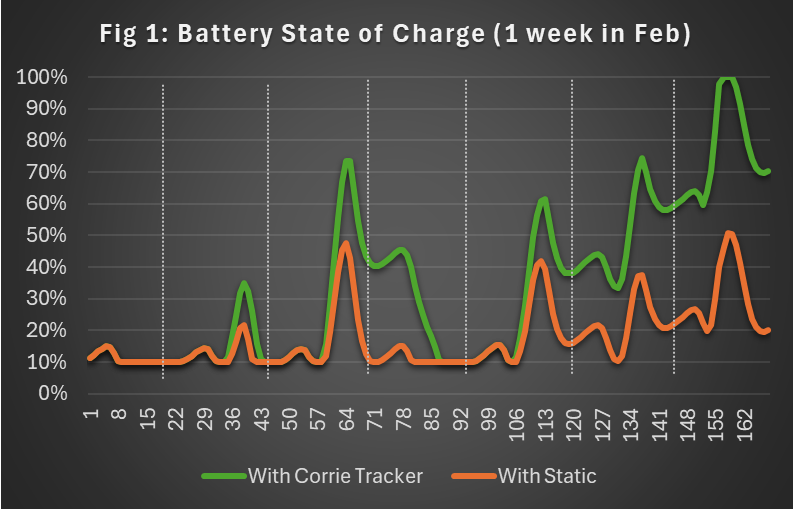

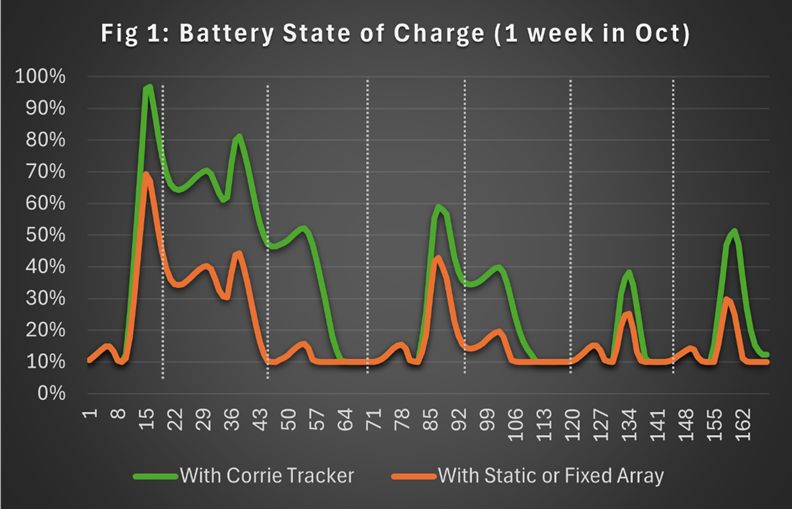

With a fixed solar array, you have a short, sharp peak of generation to charge your BESS. A tracker extends and increases your charging period, allowing more flexibility to charge and discharge your BESS at more efficient rates. Figs 1a and b show the charge cycle of a week in Feb and October, showing the tracking combination with a much higher state of charge, allowing more close alignment with your site’s demand. This reduces stress on the BESS, improves its round-trip efficiency, and extends its operational life resulting in a double benefit:

- More kWh: A tracker provides more energy to store, directly increasing the daytime arbitrage value.

- Lower Lifetime Cost of Storage: By increasing the total energy throughput of the BESS over its life, the tracker lowers the cost of storage for every cycle, both day and night, improving BESS returns.

Minimising Grid Constraints

Trackers are also a powerful tool for beating grid constraints. For any grid-constrained site, the maximum installed capacity is typically the combined capacity of the BESS and solar inverters. Trackers multiply the energy (kWh) you can generate AND store for a given grid connection capacity (kW), without any grid impact. This maximizes the value of your finite grid connection, without expensive grid upgrades.

In Conclusion

While the predictable income from grid arbitrage is a great foundation, the true financial potential of solar and storage is realized by maximizing your BESS cycling. By focusing on complementary technologies, businesses can ensure their BESS is more profitable for longer, leading to smarter, more resilient projects with higher returns.