The IEA’s Renewables 2025 report of last week serves as a clear mandate to abandon the “herd mentality” that currently dominates project design. Price volatility continues to move the renewables conversation away from peak energy output, towards efficiency.

The IEA reinforced the message of growth – but also the need for flexibility in generation. Solar PV is driving 80% of total new renewable capacity through 2030. This enormous, concentrated volume is causing widespread price cannibalisation and a surge in negative pricing during the midday peak, exposing developers to serious revenue risk. With the growth in renewables (28% of global electricity by 2030), we must move away from a midday solar generation peak. System resilience now depends on duration and flexibility.

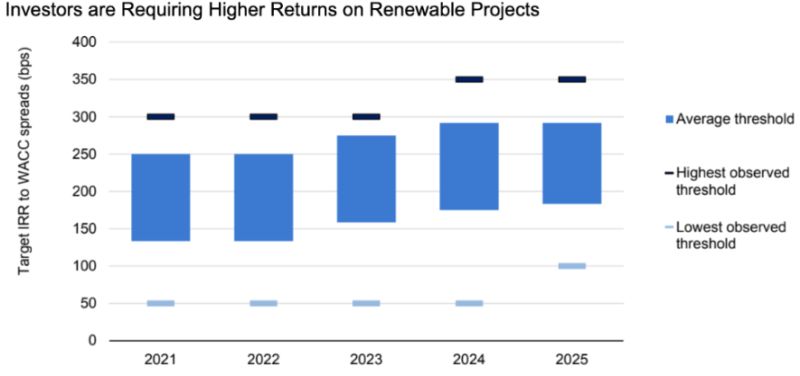

The industry is caught in a self-defeating loop: we are optimising investment and deployment around the hour that is already the least valuable. If your project is using fixed solar panels, you are maximizing your exposure to market volatility. This is a failure of financial engineering at a time when investors are requiring higher project returns.

The Corrie Philosophy: Economic Duration

The IEA report is a clear endorsement of Corrie’s philosophy to focus on economic duration. Price cannibalisation is not hedgeable and we provide a physical solution that address the IEA’s challenges directly:

Beat the Cannibalisation: We generate much more in the high-value morning and evening shoulder periods, securing a higher average selling price and reducing exposure to the midday price collapse. We deliver high-value kWhs when the grid needs them most.

De-Risk Storage: A wider generation profile is the most efficient input for BESS. It extends the charging window, maximizing the depth of discharge and the number of profitable cycles. This secures a superior financial foundation for your entire storage investment.

The market is rapidly maturing. We must move past the simple pursuit of peak power and focus on securing economic duration. Stop engineering for the herd. Engineer for the market reality and your investor will thank you.